50+ Digital Marketing Strategies for Financial Advisors

Our team of digital advertising consultants know the latest internet advertising trends for financial advisors.

Over the years, we've worked with a wide variety of financial advisors to help improve their online marketing. The tactics discussed in this section can help with online advertising for financial advisors and even:

- Banks

- Credit Unions

- Wealth Management Firms

- Online Payment Processors

- Crowdfunding Platforms

- Peer-to-peer Lending Companies

- ...and more!

A Few of Our digital marketing experts

1.) Lead Generation for Financial Companies

Lead generation is a digital marketing strategy that can greatly benefit financial companies. It focuses on attracting potential customers and capturing their contact information to convert them into clients. By implementing targeted lead generation tactics, you can effectively grow your client base and increase business opportunities. Here are 5-10 specific strategies tailored to financial companies:

- Free Financial Guides or E-books: Offer free financial guides or e-books on topics such as personal finance, investment strategies, or retirement planning. Allow visitors to download these resources in exchange for their contact information. By providing valuable educational content, you can generate leads who are interested in your financial expertise.

- Email Newsletters with Financial Insights: Develop regular email newsletters that provide financial insights, market updates, or investment tips. Allow visitors to subscribe on your website and provide their contact information. By nurturing these relationships through informative content, you can generate leads who are interested in staying updated and seeking your financial services.

- Targeted LinkedIn Outreach for Business Services: Utilize LinkedIn to identify and reach out to individuals who may require your financial services for their businesses. Tailor your messaging to address their specific needs, such as accounting, tax planning, or financial consulting. By engaging with business professionals directly, you can generate leads who are interested in improving their financial operations.

- Webinars or Online Workshops: Host webinars or online workshops on relevant financial topics, such as wealth management, investment strategies, or retirement planning. Provide valuable insights and practical advice during these sessions. Collect contact information from participants interested in learning more. By showcasing your expertise and providing valuable content, you can generate leads who are interested in your financial services.

- Targeted Google Ads for Financial Planning: Utilize Google Ads to run advertising campaigns targeted at individuals searching for financial planning services. Highlight your expertise in financial planning and emphasize the benefits of working with a professional. By appearing in search results, you can generate leads who are actively seeking financial planning services.

- Collaboration with Professional Networks: Establish partnerships with professional networks, such as industry associations, business groups, or chambers of commerce. Offer presentations, workshops, or educational sessions for their members. By positioning yourself as an expert in the financial field, you can generate leads from professionals who are interested in your services.

- Targeted Facebook Ads for Personal Finance: Utilize Facebook's advanced targeting features to run advertising campaigns aimed at individuals interested in personal finance, budgeting, or financial independence. Highlight the benefits of managing personal finances effectively and emphasize the value of your financial services. By reaching out to individuals seeking personal finance solutions, you can generate leads interested in your financial expertise.

- Online Reviews and Testimonials: Encourage satisfied clients to leave reviews and testimonials on popular review websites or your Google My Business listing. These reviews act as social proof and can help build trust with potential clients. By showcasing the positive experiences of previous clients, you can generate leads who are influenced by the feedback and are more likely to choose your financial services.

- Collaboration with HR Departments: Establish partnerships with local businesses' HR departments. Offer financial education sessions or retirement planning workshops for their employees. Provide informational materials for distribution. By partnering with companies, you can generate leads from employees who are interested in improving their financial well-being.

2.) Social Advertising for Finance Companies

Social advertising is a highly effective digital marketing strategy for finance companies to build brand authority, reach potential clients, and drive leads. By leveraging social media platforms, you can engage with your target audience, showcase your expertise, and establish trust in your financial services. Here are five specific examples of how social advertising can benefit your finance business:

- Promoting Financial Planning Services: Use social media ads to promote your financial planning services to individuals seeking professional advice for their financial goals. Target individuals based on life events, such as marriage or retirement, which often prompt the need for financial planning. By addressing specific financial needs, you can attract potential clients looking for tailored financial solutions.

- Targeting Small Business Owners: Utilize social advertising to target small business owners in need of financial services like accounting, bookkeeping, or business loans. Tailor your ads to address the financial challenges faced by entrepreneurs. By reaching out to small business owners, you can establish your finance company as a trusted partner for their financial needs.

- Sharing Investment Insights: Craft social media ads to share investment insights and market updates. Position yourself as an expert in financial markets and offer valuable advice on investment opportunities. By providing useful financial information, you can build credibility and attract potential investors seeking sound financial guidance.

- Promoting Mortgage Solutions: Use social advertising to promote your mortgage services to potential homebuyers. Target individuals based on their demographics, interests, and location to reach prospective homebuyers in specific areas. By addressing the complex process of obtaining a mortgage, you can attract individuals looking for reliable mortgage solutions.

- Offering Free Financial Workshops: Create social media ads to promote free financial workshops or webinars on topics like budgeting, retirement planning, or debt management. Encourage individuals to register for these educational events. By providing free educational resources, you can establish your finance company as a trusted source of financial knowledge.

3.) Conversion Rate Optimization (CRO) for Financial Firms

Conversion rate optimization is an essential digital marketing strategy for financial firms like yours to optimize your website and paid advertising efforts. By strategically improving user experience and engagement, you can attract more potential clients and increase the conversion rate of website visitors into valuable leads and inquiries for your financial services.

- Clear and Concise Value Proposition: Clearly communicate your financial firm's unique value proposition on your website's homepage. A well-defined value proposition can immediately capture visitors' attention and differentiate your services, encouraging potential clients to explore further and inquire about your offerings.

- Trust-Building Testimonials and Case Studies: Showcase client testimonials and success stories on your website to build trust and credibility. Positive feedback from satisfied clients can demonstrate the effectiveness of your financial services, boosting confidence and increasing the likelihood of new client inquiries.

- Free Financial Consultations: Offer free financial consultations for potential clients. Providing a no-obligation consultation can give potential clients the opportunity to discuss their financial needs and challenges, fostering trust and ultimately leading to more qualified leads for your financial services.

- Targeted Paid Advertising for Specific Services: Use targeted paid advertising campaigns to promote specific financial services that align with potential clients' needs. Tailoring your ads to specific target audiences can increase the relevance of your offerings and attract more qualified leads to your website.

- Informative Content Resources: Create informative blog posts, articles, or financial guides on your website. Providing valuable content can position your financial firm as a thought leader and resource in the industry, attracting potential clients seeking expert advice and solutions for their financial needs.

- Responsive and Mobile-Friendly Website: Ensure that your website is fully responsive and optimized for mobile devices. Many potential clients may research financial services on their smartphones, and a seamless mobile experience can improve engagement and lead to more inquiries.

- Visible and Easy-to-Find Contact Information: Place visible and easy-to-find contact information, such as phone numbers and email addresses, on your website's header and footer. Simplifying the process for potential clients to contact your financial firm can increase the number of inquiries and leads.

- Interactive Financial Calculators: Implement interactive financial calculators on your website, such as mortgage or retirement calculators. These tools can provide personalized insights for potential clients, encouraging them to take further action and reach out for your expert financial advice.

- Engaging Webinars and Workshops: Host webinars or workshops on financial topics of interest to potential clients. Inviting visitors to sign up for these events on your website can capture leads and allow you to establish connections with potential clients, potentially leading to long-term business relationships.

- Custom Landing Pages for Paid Campaigns: Create custom landing pages for specific paid advertising campaigns. Tailoring landing pages to match the ad's content and target audience can increase relevance and improve the conversion rate of ad clicks into inquiries or leads.

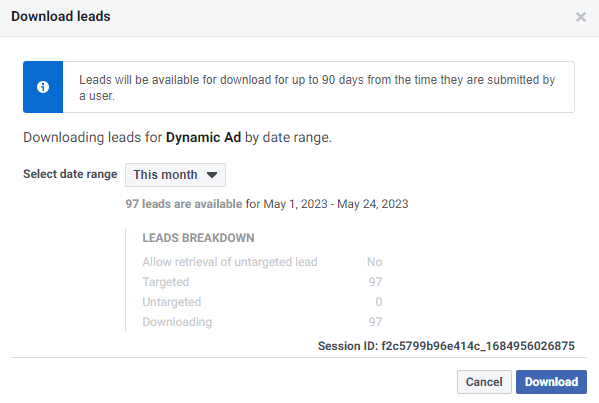

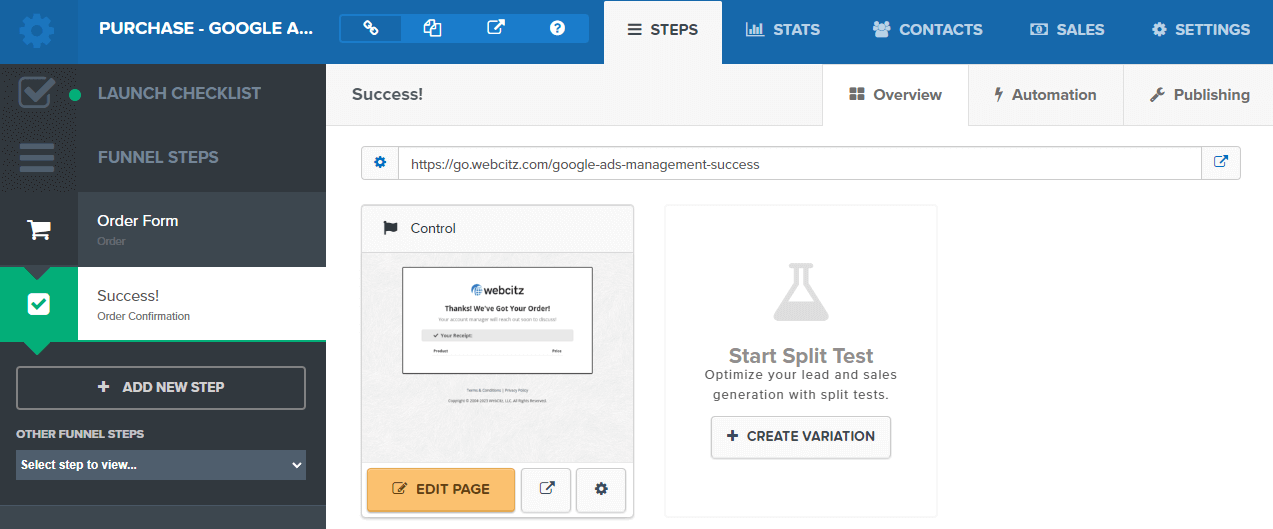

4.) Sales Funnels for Financial Companies

As a financial company, sales funnels can be a powerful digital marketing strategy to attract and convert potential clients by providing valuable financial solutions. Sales funnels are a series of targeted steps designed to guide prospects from awareness to becoming loyal customers. Here are 5 examples of how sales funnels can benefit your financial business:

- Retirement Planning Funnel: Create a landing page that offers a free downloadable guide on retirement planning. Use social media and search engine advertising to drive traffic to the landing page. Offer a free webinar or consultation on retirement planning topics for those who sign up. Follow up with personalized emails containing valuable retirement planning tips and insights. Nurture the leads with content that highlights the benefits of your financial planning services for a secure retirement.

- Investment Advice Funnel: Design a landing page with a quiz that assesses an individual's risk tolerance and investment goals. Use email marketing to send personalized investment advice based on their quiz results. Offer a free investment analysis or portfolio review to interested prospects. Follow up with educational content about various investment options and strategies. Utilize retargeting ads to keep your financial services top-of-mind for potential investors.

- Debt Management Funnel: Create a landing page that offers a free e-book or video series on effective debt management strategies. Promote the landing page through targeted ads and social media. Offer a free consultation to individuals seeking personalized debt management solutions. Follow up with a series of emails that provide practical tips on debt reduction and financial discipline. Showcase success stories of clients who have successfully managed their debt with your assistance.

- Small Business Financing Funnel: Design a landing page that offers a checklist or guide on securing financing for small businesses. Use content marketing to drive traffic to the landing page. Offer a free financial consultation for small business owners looking to expand or fund their operations. Follow up with email campaigns that highlight different financing options and their potential benefits. Utilize case studies to showcase how your financial solutions have helped other small businesses grow.

- Insurance Coverage Funnel: Create a landing page that offers a free insurance assessment tool. Use online advertising and social media to reach individuals looking for insurance coverage. Provide a free consultation to review their insurance needs and offer tailored coverage options. Follow up with educational content on different types of insurance and the importance of adequate coverage. Utilize testimonials and client success stories to build trust and credibility.

5.) Email Marketing for Financial Firms

Email marketing is an essential digital marketing strategy for financial firms like yours. It enables you to build trust, establish expertise, and nurture leads. Here are six examples of how email marketing can benefit your financial organization:

- Market Updates and Insights: Send regular emails with market updates, economic insights, and investment trends to your subscribers. Providing valuable financial information positions your firm as a trusted authority in the industry and keeps your audience informed about potential opportunities and risks.

- Financial Planning Tips: Share personalized financial planning tips based on your subscribers' goals and life stages. For instance, you can send retirement planning tips to older subscribers and budgeting advice to younger ones. Providing tailored advice showcases your expertise and helps in building long-term relationships with your audience.

- Webinar and Seminar Invitations: Invite your subscribers to attend webinars, seminars, or workshops hosted by your firm. Topics can range from investment strategies to tax planning. Webinars and seminars offer opportunities to engage with prospects and clients, demonstrate your knowledge, and convert leads into customers.

- Client Success Stories: Share success stories and case studies of satisfied clients who have achieved financial goals with your firm's assistance. Testimonials and real-life examples of your firm's positive impact can inspire trust and encourage potential clients to consider your services.

- Regulatory Updates and Compliance Information: Send updates on changing financial regulations and compliance requirements. Keeping your audience informed about relevant regulatory changes demonstrates your commitment to transparency and helps clients stay compliant with financial regulations.

- Exclusive Financial Offers: Offer exclusive financial products or services to your email subscribers. For example, you can provide limited-time discounts on specific investment plans or waive certain fees for a period. Exclusive offers give your subscribers an incentive to take action and engage with your firm.

6.) Search Advertising for Finance Companies

Search advertising can be a powerful strategy to promote your financial services and connect with potential clients seeking financial solutions. By utilizing search ads, you can reach individuals actively searching for financial advice and services, making your company more visible and increasing leads. Below are five examples of how search advertising can benefit your finance business and help you thrive:

- Personal Finance Guidance: Create search ads to offer personal finance guidance to individuals seeking financial advice. Target keywords like "financial planning tips" or "how to manage money effectively" to connect with users looking for ways to improve their financial health. This strategy positions your finance company as a reliable source of financial expertise.

- Local Financial Services: Run search ads to promote your financial services within your local area. When people in your community search for terms like "financial advisors near me" or "local investment firms," your ad can appear at the top of search results, increasing visibility to potential clients looking for finance professionals in their vicinity.

- Retirement Planning Solutions: Advertise your retirement planning services through search ads. Target keywords like "retirement planning experts" or "401(k) advisors" to reach individuals seeking assistance in preparing for their future retirement. This strategy positions your finance company as a valuable partner in retirement preparation.

- Investment Opportunities: Showcase investment opportunities through search ads to attract potential investors. Use keywords like "high-yield investments" or "real estate investment options" to connect with individuals looking to grow their wealth through strategic investments.

- Debt Management Services: Create search ads to promote debt management services and debt consolidation solutions. Target keywords like "debt relief options" or "credit card debt help" to reach individuals seeking ways to manage and reduce their debt burdens. This strategy positions your finance company as a valuable resource in achieving financial stability.

7.) Content Marketing for Finance Companies

Content marketing is a valuable digital strategy that can significantly benefit your finance company. By creating informative and insightful content, you can attract potential clients, showcase your expertise in financial services, and establish trust with individuals seeking reliable and knowledgeable financial advice.

- Financial Planning Guides: Develop comprehensive financial planning guides that cover various aspects of personal finance, such as budgeting, investing, and retirement planning. Offer practical tips and strategies that can help individuals achieve their financial goals. This content positions your finance company as a trusted source of financial knowledge and attracts clients seeking expert guidance.

- Market Insights and Analysis: Create content that offers market insights and financial analysis related to investments, stocks, or economic trends. Provide data-driven reports and expert opinions that help potential investors make informed decisions. This content positions your finance company as a reliable advisor in navigating the complexities of the financial market.

- Debt Management Resources: Develop resources and tools to help individuals manage their debts effectively. Offer debt repayment calculators, debt consolidation guides, and advice on improving credit scores. This content positions your finance company as a valuable partner in helping clients regain financial stability and manage debt responsibly.

- Retirement Planning Seminars: Host virtual retirement planning seminars or webinars that cover topics like retirement income strategies, tax planning, and estate planning. Provide actionable insights and personalized advice to participants. This content showcases your finance company's expertise in retirement planning and attracts potential clients preparing for their future.

- Client Success Stories: Share authentic client success stories and testimonials from individuals who have achieved financial success with your services. Include case studies that illustrate the positive impact of your financial advice on clients' lives and financial well-being. This content builds trust and credibility in your finance company's ability to deliver tangible results.

8.) Reputation Management for Finance Companies

As a finance company, reputation management is a crucial digital marketing strategy that can significantly impact your business success and attract more clients. It involves actively shaping and maintaining the online perception of your financial services. Here are five tailored examples of how reputation management can benefit your finance company:

- Showcasing Expertise through Thought Leadership: Create and share insightful content on financial topics like investment strategies, tax planning, or retirement planning. Publish blog posts, videos, or infographics on your website and social media channels. This thought leadership approach will position your finance company as a trusted authority in the industry, attracting potential clients seeking expert financial advice.

- Client Testimonials and Success Stories: Feature testimonials from satisfied clients who have achieved financial success through your services. Display these endorsements on your website and marketing materials. Positive feedback from real clients will enhance your reputation as a finance company that delivers valuable results and builds trust with potential clients.

- Online Reputation Monitoring and Responding: Regularly monitor online platforms and review sites for feedback about your finance company. Respond to both positive and negative reviews with professionalism and empathy. Addressing concerns and acknowledging positive feedback will demonstrate your commitment to excellent customer service and improve your reputation.

- Secure and Informative Website: Ensure that your finance company's website is secure and user-friendly. Offer valuable resources like financial calculators, budgeting tools, or educational materials. A well-designed website with valuable resources will enhance your reputation as a trustworthy and client-focused finance company.

- Client Privacy and Security Measures: Highlight the security measures you have in place to protect your clients' sensitive financial information. Emphasize your commitment to client privacy and data protection on your website and in client communications. This emphasis on security will enhance your reputation as a reliable and trustworthy finance company, encouraging potential clients to entrust you with their financial needs.

9.) Video Marketing for Finance Companies

As a finance company, you can communicate complex financial concepts, build trust with clients, and establish your expertise in the financial industry. Video content offers you a dynamic platform to educate your audience, share valuable insights, and promote your financial services. Here are five powerful examples of how video marketing can benefit your finance company:

- Financial Education Series: Create a series of informative videos that explain various financial topics, such as budgeting, investing, or retirement planning. Break down complex concepts into easy-to-understand visuals and offer actionable advice. Financial education videos position your company as a trusted financial advisor, attracting potential clients seeking knowledge and guidance.

- Client Success Stories: Film video testimonials from satisfied clients who have achieved their financial goals with your assistance. Let them share their success stories and how your financial services have positively impacted their lives. Client success story videos build credibility and trust, encouraging new clients to choose your finance company for their financial needs.

- Market Analysis and Insights: Offer video content that provides market analysis and insights on the financial landscape. Discuss trends, market movements, and potential investment opportunities. Market analysis videos establish your company as a thought leader in finance and attract potential clients seeking expert advice on their financial decisions.

- Live Webinars and Q&A Sessions: Host live webinars or Q&A sessions where you address common financial questions and concerns from your audience. Provide real-time answers and engage with participants to foster a sense of community. Live webinars and Q&A sessions demonstrate your accessibility and commitment to helping clients with their financial queries.

- Investment Strategy Explainers: Create video content that explains your investment strategies and how they align with clients' financial goals and risk tolerance. Use visuals to illustrate investment performance and potential returns. Investment strategy explainer videos instill confidence in your financial services and encourage potential clients to entrust their investments with your company.

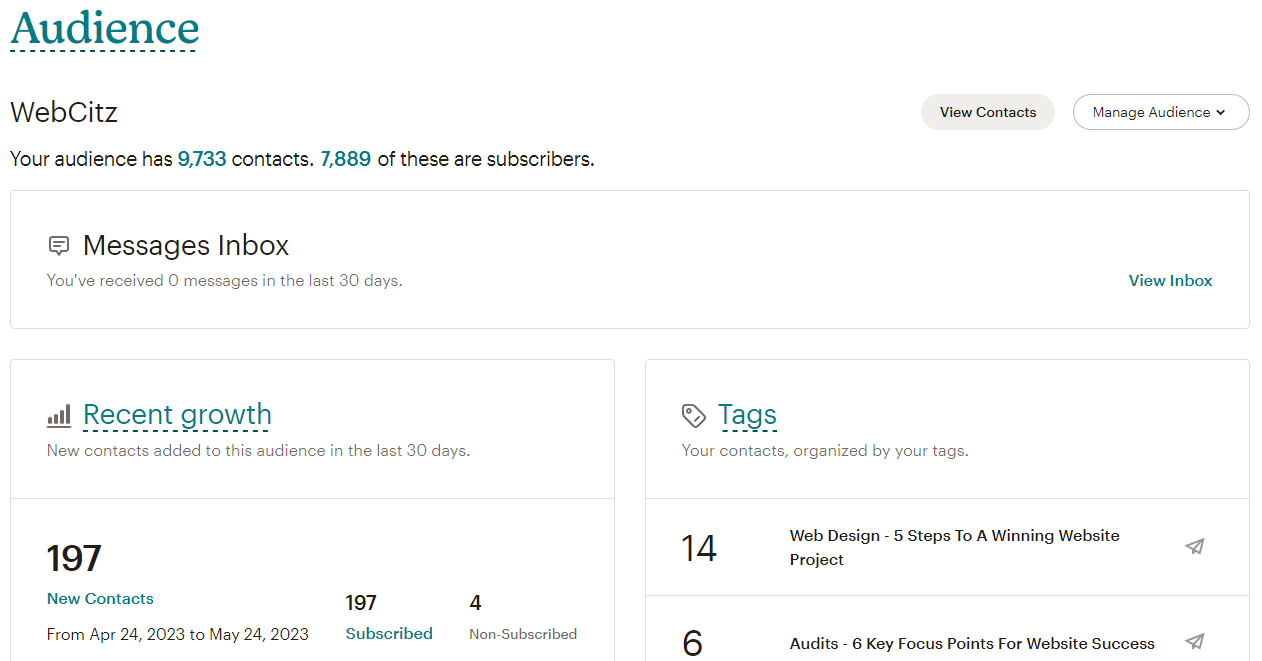

Why Choose WebCitz for Your Financial Firm Website Marketing

Our team is eager to become your website advertising partner! There are many factors to consider when researching digital marketing agencies for financial advisors. You can rest assured that our digital advertising plans and strategies for your financial firm are trustworthy, thanks to our 20 years of experience. These are commonly the online marketing plans we apply for our own lead generation and conversion rate optimization campaigns. Chances are, you found our website through our successful digital marketing efforts.

Most importantly though, you should choose our digital marketing company because you feel confident we are the right team for your financial firm. Why choose our internet marketers for your financial firm? Here are a few compelling reasons:

- With over 20 years of experience, we have been operating our business since 2004.

- Our primary source for leads from financial advisors is our own internet advertising tactics.

- Our website may have come up in your search results after you searched for a service we specialize in, like "financial advisor website marketing plans."

- Our financial firm digital marketing campaigns are handled entirely by our in-house team, and we do not outsource any part of the process.

- Our team members are readily available during business hours and will likely answer your call within a few rings.

- We have extensive experience in Shopify and WordPress for any internet advertising tactics that involve website changes.

When the time comes to look for a leading website advertising firm, we hope that you'll consider our digital marketers for the job. Should you require any additional information or wish to chat with our helpful staff at the digital advertising firm, please don't hesitate to reach out via email or phone.

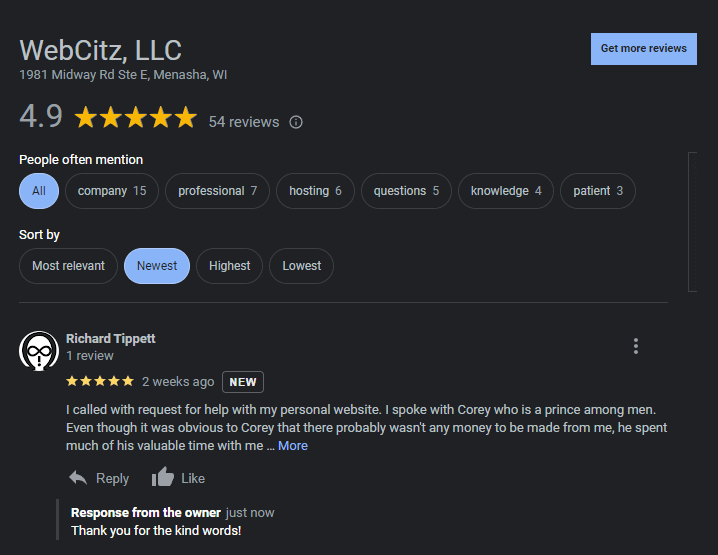

Hear what our customers are saying